What is Double-Top and Double-Bottom Patterns? : Understanding the Double-Top and Double-Bottom Pattern

Introduction

In the world of technical analysis, chart patterns play a crucial role in predicting future price movements. One such pattern is the double-top pattern, which serves as a bearish reversal signal. This article explores the intricacies of the double-top pattern, its formation, and its significance in the financial markets.

Understanding the Double-Top Pattern

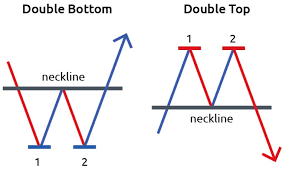

The double-top pattern is characterized by two consecutive peaks with approximately the same highs. It typically forms after a strong upward move in an uptrend. The first peak represents a temporary high, and after facing resistance, the price pulls back, creating a support level called the neckline. The price then moves back towards the resistance level set by the first peak but fails to break it, resulting in a downward movement towards the neckline again.

Formation of the Double-Top Pattern

Let's examine the formation of the double-top pattern in detail. Initially, the price is in an uptrend, creating a new high as the bulls drive the market. However, as the bulls start losing momentum, the market enters a consolidation phase and experiences a pullback. The bulls attempt to push the price to new highs but fail, giving way to the bears who gain control and drive the price down. It is important to note that the double-top pattern is only valid when the price breaks below the neckline.

The Relationship between Bulls and Bears

The double-top pattern offers valuable insights into the battle between bulls and bears in the market. The initial uptrend showcases the dominance of the bulls, pushing the price to new highs. However, as the bulls lose steam and the market consolidates, the bears start gaining control. The failed attempts of the bulls to break the resistance level signify the increasing influence of the bears, ultimately leading to a bearish reversal.

Validity and Entry Strategies for the Double-Top Pattern

Determining the validity of the double-top pattern is crucial for successful trading. Traders have two basic strategies when it comes to entering the market based on this pattern. Aggressive traders sell immediately after the price breaks below the neckline, anticipating a further decline. On the other hand, conservative traders wait for the price to rise back to the neckline and only sell once it confirms the bearish reversal.

Setting Price Targets and Taking Profits

One of the advantages of formation patterns like the double-top is the ease of setting price targets. Traders can measure the height of the formation, which is the distance from the neckline to the peak. This measurement helps in determining the potential downward movement of the price. Traders can then set their profit targets by subtracting the measured distance from the neckline to the downside.

The Double Bottom Pattern: A Bullish Reversal

In contrast to the double-top pattern, the double bottom pattern signals a bullish reversal. It consists of two consecutive bottoms with approximately the same lows and an incline acting as resistance. Similar to its bearish counterpart, the double bottom pattern is only valid when the price breaks above the neckline.

Validity and Breakout of the Double Bottom Pattern

To identify a valid double bottom pattern, traders need to observe the breakout above the neckline. This breakout confirms the bullish reversal and presents an opportunity for traders to enter the market. Similar to the double-top pattern, the height of the formation can be used to set price targets for taking profits in the upward movement.

Subtle Differences between the Double-Top and Double-Bottom Patterns

While the double-top and double-bottom patterns share similarities, there are subtle differences that traders need to be aware of. The double-top pattern forms after a strong upward move, indicating a bearish reversal, whereas the double-bottom pattern forms after a strong downtrend, signaling a bullish reversal. Understanding these distinctions is crucial for accurate analysis and decision-making.

Analyzing the Double-Top Pattern on Price Charts

To effectively analyze the double-top pattern on price charts, traders should consider using technical analysis tools and indicators. Here are some key techniques to aid in the identification and confirmation of this bearish reversal pattern:

a) Trend Analysis

Before identifying a double-top pattern, it's crucial to determine the prevailing trend. The pattern is most reliable when it forms within the context of an established uptrend. Analyzing the overall price action and trend can help traders spot potential double tops.

b) Confirmation Indicators

To increase the accuracy of identifying a double-top pattern, traders often rely on additional confirmation indicators. These indicators can include oscillators, such as the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD). Confirmation indicators can provide insights into overbought conditions or bearish divergence, strengthening the validity of the pattern.

c) Volume Analysis

Analyzing trading volume can provide valuable clues when confirming a double-top pattern. Typically, traders expect to see a decrease in volume during the formation of the second peak compared to the first peak. This decline in volume suggests diminishing bullish momentum, reinforcing the bearish reversal signal.

Exploring Real-Life Examples of the Double-Top Pattern

To illustrate the practical application of the double-top pattern, let's explore a real-life example. Consider a stock that has been on a significant uptrend, with prices steadily climbing. As the price reaches a new high, forming the first peak, bullish traders become increasingly confident. However, the market encounters resistance at this level, causing the price to pull back.

Once the price recovers and attempts to surpass the previous high, it fails to break through the resistance. The bears gain control, and the price drops, reaching the neckline. This validates the double-top pattern, indicating a bearish reversal may be underway. Traders who followed the pattern's entry strategies may have sold their positions, anticipating further downside movement.

Common Mistakes to Avoid when Trading the Double-Top Pattern

While the double-top pattern can be a powerful tool in technical analysis, it's important to be aware of common mistakes that traders should avoid:a) Premature Entry or Exit

Entering or exiting trades too early can lead to missed opportunities or premature losses. It's essential to wait for confirmation of the pattern, such as a clear breakout below the neckline, before initiating a trade.

b) Neglecting Other Technical Indicators

Relying solely on the double-top pattern without considering other technical indicators can limit the accuracy of your analysis. It's crucial to incorporate additional tools, such as volume analysis or trend confirmation indicators, to increase the reliability of your trading decisions.

c) Ignoring Market Context

Market context plays a significant role in the success of trading decisions. Failing to consider broader market conditions, news events, or fundamental factors can lead to misguided interpretations of the double-top pattern.

Conclusion

The double-top pattern is a widely recognized bearish reversal pattern that provides valuable insights into market dynamics. By understanding its formation, validity, and application in trading strategies, traders can enhance their technical analysis skills and make more informed decisions.

Remember, consistent success in trading requires continuous learning, adaptability, and risk management. As you integrate the double-top pattern into your trading arsenal, remain vigilant and combine it with other technical tools to increase your probability of profitable trades.

(FAQs) about the double-top pattern:

Q1: How can I identify a double-top pattern on a price chart?

A1: To identify a double-top pattern, look for two consecutive peaks with similar highs, followed by a downward movement towards the neckline. This pattern indicates a potential bearish reversal.Q2: Is the double-top pattern always a reliable bearish reversal signal?

A2: While the double-top pattern is widely recognized as a bearish reversal signal, it's important to consider other technical indicators and market conditions for confirmation. Using additional tools can increase the accuracy of your analysis.Q3: Can the neckline of a double-top pattern act as a support level?

A3: Yes, the neckline of a double-top pattern can act as a support level during the formation of the pattern. Traders often observe the price bouncing off the neckline before the breakdown occurs.Q4: How do I confirm the validity of a double-top pattern?

A4: To confirm the validity of a double-top pattern, wait for a clear breakout below the neckline. The breakout serves as confirmation of the bearish reversal. Additionally, consider using volume analysis and other technical indicators to support your analysis.Q5: Are there any variations of the double-top pattern?

A5: While the classic double-top pattern consists of two peaks with similar highs, variations can occur. Some variations include slightly unequal highs or a more extended consolidation period between the peaks. However, the essential characteristic is still the formation of two consecutive peaks followed by a bearish reversal.