Bullish and Bearish Piercing Candlestick Patterns: Unlocking Reversal Signals for Intraday Trading Success

In the competitive world of trading, investors and traders are constantly seeking an edge to make informed decisions and achieve success. Among the arsenal of tools available, candlestick patterns have long been recognized as powerful indicators that can provide valuable insights into market trends and potential reversals. In this comprehensive guide, we will delve into the intricacies of two key candlestick patterns - the bullish and bearish piercing patterns - and explore how they can

help unlock reversal signals for intraday trading success.

Importance of Candlestick Patterns in Trading

Candlestick patterns have stood the test of time as a visual representation of price movements in financial markets. Their significance lies in their ability to capture market sentiment and predict potential trend changes. By analyzing the formations and characteristics of candlestick patterns, traders gain valuable insights that enable them to enter or exit positions with increased confidence. Of the vast array of candlestick patterns available, the bullish and bearish piercing patterns have garnered widespread recognition for their reliability in predicting trend reversals.

Understanding the Candlestick Patterns

Definition and Appearance

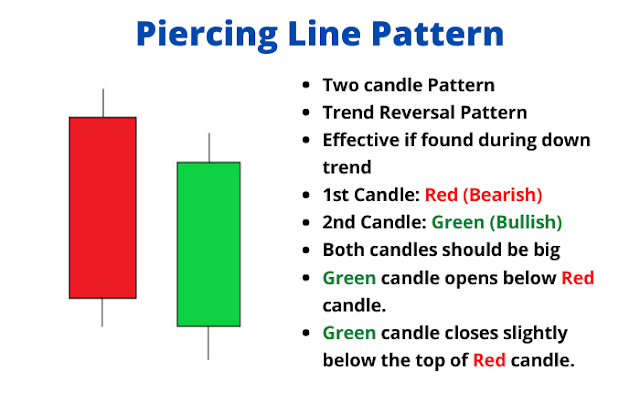

The bullish piercing candlestick pattern is a two-candle formation that typically occurs during a downtrend. It serves as a potential reversal signal, indicating a shift in control from bears to bulls. The pattern consists of a bearish (red) candle followed by a bullish (green) candle.

Identifying Bullish Piercing Pattern

To identify a bullish piercing pattern, pay attention to the following characteristics:

- The first candle should be bearish, representing a prevailing downtrend.

- The second candle should open lower than the previous candle's close.

- The second candle should close above the midpoint of the first candle's body.

Trading Strategy for Bullish Piercing Pattern

Once a bullish piercing pattern is confirmed, traders can consider implementing the following strategy:

- Wait for the pattern to complete and validate the bullish signal.

- Enter a long position above the high of the second candle.

- Place a stop-loss order below the low of the first candle to manage risk.

- Set a target price based on individual risk tolerance and profit goals.

Understanding the Bearish Piercing Candlestick Pattern

Definition and Appearance

In contrast to the bullish piercing pattern, the bearish piercing candlestick pattern emerges during an uptrend and indicates a potential reversal to the downside. The pattern is comprised of a bullish (green) candle followed by a bearish (red) candle.

Identifying Bearish Piercing Pattern

To identify a bearish piercing pattern, consider the following characteristics:

- The first candle should be bullish, signifying an existing uptrend.

- The second candle should open higher than the previous candle's close.

- The second candle should close below the midpoint of the first candle's body.

Trading Strategy for Bearish Piercing Pattern

When a bearish piercing pattern is confirmed, traders can implement the following strategy:

- Wait for the pattern tocomplete and validate the bearish signal.

- Enter a short position below the low of the second candle.

- Place a stop-loss order above the high of the first candle to manage risk.

- Set a target price based on individual risk tolerance and profit goals.

Real-Life Examples of Bullish and Bearish Piercing Patterns

Examining real trading scenarios can provide a practical understanding of how bullish and bearish piercing patterns manifest. Let's explore a couple of examples:

Bullish Piercing Pattern Example:

Imagine a stock in a clear downtrend, characterized by a sequence of red candles. Suddenly, a green candle emerges, opening below the previous red candle's close but closing above its midpoint. This pattern suggests a potential trend reversal. Traders can enter a long position once the stock breaks above the high of the green candle.

Bearish Piercing Pattern Example:

Consider a stock experiencing an uptrend, with a consistent series of green candles. Suddenly, a red candle forms, opening above the previous green candle's close but closing below its midpoint. This pattern hints at a possible shift in the trend. Traders can consider entering a short position once the stock breaks below the low of the red candle.

Tips for Using Candlestick Patterns in Intraday Trading

While candlestick patterns offer valuable insights, it's crucial to consider additional factors and follow best practices for successful intraday trading. Here are some tips to enhance your trading strategy:

- Proper Chart Analysis: Combine candlestick patterns with other technical analysis tools, such as support and resistance levels, moving averages, and volume indicators, to validate trade setups and increase reliability.

- Confirmation from Other Indicators: Seek confirmation from other indicators or chart patterns to reinforce the probability of a successful trade. For instance, wait for a bullish or bearish candlestick pattern to coincide with a significant support or resistance level.

- Risk Management: Implement proper risk management techniques, including setting stop-loss orders and determining position sizes based on your risk tolerance and overall trading plan.

Introduction to the Course for Consistent Profits in Intraday Trading

If you are new to stock market trading or seeking consistent profits, enrolling in a comprehensive trading course could be an excellent decision. Our meticulously designed course offers invaluable insights and strategies to help you achieve consistent success in intraday trading. Here's an overview of what you can expect:

- Course Overview: Gain an in-depth understanding of intraday trading strategies, risk management techniques, and market analysis methods.

- Unique Strategies for 95% Accuracy: Learn highly accurate and unique trading strategies with a proven success rate of 95%.

- Money Management and Risk-Free Trading: Discover effective money management systems and risk-free trading techniques to safeguard your capital and maximize profits.

Conclusion

Candlestick patterns, including the bullish and bearish piercing patterns, serve as invaluable tools for predicting potential trend reversals in intraday trading. By mastering these patterns and effectively integrating them into your trading strategy, you can enhance your decision-making process and improve overall trading performance. Remember to combine candlestick patterns with other technical indicators, practice proper risk management, and adapt to market conditions to increase the probability of successful trades.

FAQs

Q1. Are candlestick patterns reliable indicators of market reversals?

A1. While candlestick patterns can provide reliable indications of potential market reversals, it is important to consider other technical analysis tools and factors to confirm their validity. Comprehensive analysis is crucial for making informed trading decisions.

Q2. Can I use candlestick patterns in long-term investing?

A2. Although candlestick patterns are commonly associated with short-term trading, they can also be applied to long-term investing. However, it is essential to adapt your analysis and timeframes to align with long-term investment goals and market dynamics.

Q3. Are there other candlestick patterns I should learn about?

A3. Absolutely! Candlestick patterns offer a vast array of formations, each with its own unique characteristics and implications. It is highly beneficial to explore other patterns such as Doji, hammer, shooting star, engulfing patterns, and more to expand your trading knowledge and skills.

Q4. How can I improve my intraday trading skills?

A4. Improving your intraday trading skills requires continuous education, practice, and experience. Consider enrolling in a comprehensive trading course, studying market trends, analyzing historical data, and staying updated with the latest industry developments to enhance your skills and decision-making abilities.

Q5. Can candlestick patterns guarantee profits in intraday trading?

A5. While candlestick patterns provide valuable insights, they alone cannot guarantee profits in intraday trading or any other form of trading. Successful trading demands a comprehensive approach that incorporates various analysis techniques, risk management strategies, and market conditions. Adaptability, continuous learning, and disciplined execution are key factors in achieving consistent

profitability.