How to trade with Bullish & Bearish Kicker Candlestick Patterns

Welcome to new article. In this comprehensive guide, we will explore one of the most powerful candlestick patterns known as the Bullish and Bearish Kicker Candlestick Patterns. Candlestick patterns are widely used in technical analysis to predict market trends and potential reversals. While these patterns are not foolproof and require confirmation from other signals, understanding them can provide valuable insights for traders and investors.

Introduction

Candlestick patterns have been used for centuries to analyze and predict market behavior. The Bullish and Bearish Kicker Candlestick Patterns are two such patterns that indicate potential trend reversals. By understanding these patterns, traders can gain valuable insights into market sentiment and make informed trading decisions.

Understanding Candlestick Patterns

Before delving into the specifics of Bullish and Bearish Kicker Candlestick Patterns, it's essential to have a basic understanding of candlestick charts. These charts display the price movement of an asset over a specific time period. Each candlestick represents a trading session and provides information about the opening, closing, high, and low prices.

The body of the candlestick is filled or colored differently to represent bullish or bearish sentiment. The upper and lower wicks, or shadows, indicate the price range between the high and low of the session. Candlestick patterns emerge from the combination of these elements and offer insights into market sentiment and potential reversals.

What are Bullish and Bearish Kicker Candlestick Patterns?

Bullish and Bearish Kicker Candlestick Patterns are considered reversal patterns, indicating a potential shift in market sentiment. These patterns consist of two candlesticks and are characterized by a significant price change between them. The Bullish Kicker Pattern occurs at the end of a downtrend, while the Bearish Kicker Pattern appears at the end of an uptrend.

Bullish Kicker Candlestick Pattern

The Bullish Kicker Pattern begins with a red candlestick, representing a downtrend. It is followed by a large green candlestick with a substantial body. The size of the body is more important than the wicks or shadows, as it indicates strong conviction and a potential reversal. While the Bullish Kicker Pattern is a two-candlestick pattern, the preceding downtrend is crucial for its validity.

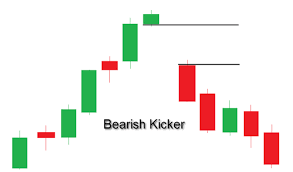

Bearish Kicker Candlestick Pattern

In contrast to the Bullish Kicker Pattern, the Bearish Kicker Pattern starts with a green candlestick, indicating an uptrend. It is then followed by a significant red candlestick with a large body. Similar to the Bullish Kicker, the size of the body holds more significance than the wicks or shadows. The Bearish Kicker Pattern suggests a conviction to the downside and a potential reversal. It is important to note that the Bearish Kicker Pattern requires a preceding uptrend for its.

The Importance of Preceding Trend

Both the Bullish and Bearish Kicker Candlestick Patterns rely on the existence of a preceding trend. The strength and significance of the pattern are enhanced when it occurs at the end of a well-established trend. This indicates a potential exhaustion of the current trend and a possible reversal in market sentiment.

For the Bullish Kicker Pattern, a preceding downtrend is necessary. It shows that the bears have been in control, driving the price down. The sudden shift to a large green candlestick signifies a strong bullish sentiment, potentially leading to a reversal in the market.

Conversely, the Bearish Kicker Pattern requires a preceding uptrend. This demonstrates the dominance of the bulls, pushing the price higher. The subsequent appearance of a large red candlestick indicates a strong bearish sentiment, suggesting a potential reversal and a shift in market sentiment.

The Role of Gaps in Kicker Candlestick Patterns

Gaps play a crucial role in the formation of Bullish and Bearish Kicker Candlestick Patterns. A gap occurs when the opening price of the second candlestick is higher (in the case of the Bullish Kicker Pattern) or lower (in the case of the Bearish Kicker Pattern) than the closing price of the previous candlestick. This gap represents a significant shift in market sentiment.

In the Bullish Kicker Pattern, a bullish gap indicates a sudden surge in buying pressure, overwhelming the sellers and signaling a potential trend reversal. Similarly, in the Bearish Kicker Pattern, a bearish gap suggests a sudden increase in selling pressure, overpowering the buyers and indicating a possible reversal in the market.

Examples of Bullish and Bearish Kicker Patterns

To better understand Bullish and Bearish Kicker Candlestick Patterns, let's look at a couple of examples:

Bullish Kicker Pattern:

- The first candlestick is red, representing a downtrend.

- The second candlestick is a large green candlestick with a substantial body, opening higher than the previous candlestick's close.

- The pattern suggests a strong bullish sentiment and a potential reversal in the market.

Bearish Kicker Pattern:

- The first candlestick is green, indicating an uptrend.

- The second candlestick is a significant red candlestick with a large body, opening lower than the previous candlestick's close.

- The pattern implies a strong bearish sentiment and a potential reversal in the market.

The Impact of Body Size on Reversal Signals

In both the Bullish and Bearish Kicker Candlestick Patterns, the size of the second candlestick's body plays a crucial role. The larger the body, the more significant the reversal signal. A small-bodied second candlestick may still indicate a potential reversal but with less conviction.

A large-bodied second candlestick signifies a substantial shift in market sentiment. It suggests that the buyers or sellers have gained control, overpowering the opposing side. This shift in power enhances the likelihood of a trend reversal, making the pattern more reliable.

Confirmation and Risk Management

While Bullish and Bearish Kicker Candlestick Patterns provide valuable insights, it's important to confirm these patterns with additional technical analysis tools and indicators. Traders should consider using other confirmation signals, such as trendlines, support and resistance levels, or oscillators, to validate the potential reversal.

Risk management is also crucial when trading based on candlestick patterns. Traders should set appropriate stop-loss orders to limit potential losses in case the anticipated reversal does not occur. Additionally, it's advisable to combine candlestick patterns with other trading strategies and risk management techniques to improve overall trading performance.

Learning and Practicing with Kicker Candlestick Patterns

To effectively incorporate Bullish and Bearish Kicker Candlestick Patterns into your trading strategy, it's essential to practice and gain experience. Here are a few suggestions to enhance your understanding and proficiency:

a. Study Resources: Explore books, online articles, and educational resources that delve into candlestick patterns and their interpretations. Understanding the underlying principles will help you recognize and interpret Kicker Candlestick Patterns accurately.

b. Chart Analysis: Spend time analyzing historical price charts to identify instances where Bullish and Bearish Kicker Candlestick Patterns occurred. Study the context in which they appeared, the preceding trend, and the subsequent price action. This practical analysis will help you develop an intuitive sense of these patterns.

c. Paper Trading: Consider practicing your trading strategy using a paper trading account or a trading simulator. This allows you to execute trades based on Kicker Candlestick Patterns without risking real money. Monitor your trades and evaluate their outcomes to refine your strategy.

d. Backtesting: Utilize historical data to backtest your trading strategy. Apply your knowledge of Bullish and Bearish Kicker Candlestick Patterns to identify potential trading opportunities. Assess the performance of your strategy over a significant period, considering factors like win rate, risk-reward ratio, and overall profitability.

e. Learning from Experience: As you gain experience in real trading situations, keep a trading journal to record your observations and lessons learned. Review your trades, noting how Kicker Candlestick Patterns influenced your decision-making process. Over time, this journal will serve as a valuable resource for refining your strategy and improving your trading skills.

Seeking Professional Guidance

If you're new to trading or wish to deepen your knowledge of candlestick patterns, consider seeking guidance from professional traders or participating in trading courses. These resources can provide valuable insights, practical examples, and mentorship to help you navigate the complexities of trading and increase your proficiency in utilizing Kicker Candlestick Patterns.

Remember, trading involves inherent risks, and no trading strategy can guarantee profits. It's essential to approach trading with a disciplined mindset, manage your risk effectively, and stay updated with market trends and news.

Conclusion

Bullish and Bearish Kicker Candlestick Patterns are powerful reversal signals that can provide valuable insights into market sentiment and potential trend reversals. These patterns, characterized by a sudden shift in sentiment and a gap in price, can assist traders in identifying favorable entry and exit points.

By understanding the principles behind these patterns and incorporating them into a comprehensive trading strategy, traders can enhance their decision-making process and improve their trading performance. However, it's important to remember that no trading signal is foolproof, and it's always recommended to combine candlestick patterns with other technical analysis tools and risk management techniques.

Here are some frequently asked questions (FAQs) about Bullish and Bearish Kicker Candlestick Patterns:

Q1: What are Bullish and Bearish Kicker Candlestick Patterns?

A1: Bullish and Bearish Kicker Candlestick Patterns are two types of candlestick patterns that provide potential signals for trend reversals. The Bullish Kicker Pattern occurs when a long bearish candle is followed by a long bullish candle, indicating a possible upward reversal. On the other hand, the Bearish Kicker Pattern occurs when a long bullish candle is followed by a long bearish candle, suggesting a potential downward reversal.

Q2: How do I identify Bullish and Bearish Kicker Candlestick Patterns?

A2: To identify a Bullish Kicker Pattern, look for a long bearish candle followed by a long bullish candle that opens higher than the previous candle's close. For a Bearish Kicker Pattern, observe a long bullish candle followed by a long bearish candle that opens lower than the previous candle's close.

Q3: What do Bullish and Bearish Kicker Candlestick Patterns indicate?

A3: Bullish Kicker Patterns suggest a possible shift from a bearish trend to a bullish trend, indicating buying pressure and potential price increases. Bearish Kicker Patterns, on the other hand, imply a potential shift from a bullish trend to a bearish trend, signaling selling pressure and possible price decreases.

Q4: Should I rely solely on Kicker Candlestick Patterns for my trading decisions?

A4: Kicker Candlestick Patterns should be used as a part of a comprehensive trading strategy and not in isolation. It is recommended to combine them with other technical indicators, such as support and resistance levels, trend lines, and volume analysis, to validate signals and make more informed trading decisions.

Q5: Do Kicker Candlestick Patterns guarantee profitable trades?

A5: No trading pattern or strategy can guarantee profits. Kicker Candlestick Patterns are simply indications of potential trend reversals. It is important to consider other factors, such as market conditions, fundamental analysis, and risk management, when making trading decisions.

Q6: Can Kicker Candlestick Patterns be used in different timeframes?

A6: Yes, Kicker Candlestick Patterns can be applied to various timeframes, including daily, hourly, or even shorter intervals. However, it's important to adapt the patterns and your trading strategy accordingly, considering the volatility and characteristics of the specific timeframe you're using.

Q7: How can I improve my skills in recognizing Kicker Candlestick Patterns?

A7: Improving your skills in recognizing Kicker Candlestick Patterns requires practice and experience. Study educational resources, analyze historical price charts, engage in paper trading or backtesting, and maintain a trading journal to learn from your experiences and refine your strategy over time.

Remember, it's always advisable to seek professional guidance and conduct thorough research before making any trading decisions.