Engulfing Candlestick Patterns: A Powerful Tool for New Traders

Are you a new trader looking to enhance your trading strategies?

One highly effective technique to consider is utilizing engulfing candlestick patterns. In this article, we will explore the concept of engulfing candlestick patterns, understand their significance in trading, learn how to identify them, and provide valuable tips for new traders to make the most out of these patterns.

Understanding Engulfing Candlestick Patterns

What is a candlestick pattern?

Before diving into engulfing candlestick patterns, let's first grasp the basic concept of candlestick patterns. A candlestick pattern is a graphical representation of price movements over a specific time period. It consists of a "candle" that has a body and "wicks" (also known as shadows) extending from it. These patterns provide valuable insights into market sentiment and can be used for making informed trading decisions.

What is an engulfing candlestick pattern?

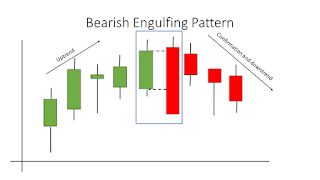

An engulfing candlestick pattern occurs when a larger candle fully engulfs the previous smaller candle. It signifies a shift in market momentum and is often seen as a strong indicator of potential trend reversals. Engulfing patterns can be either bullish or bearish, depending on the direction of the price movement.

Types of engulfing candlestick patterns

There are two main types of engulfing candlestick patterns: bullish engulfing and bearish engulfing patterns. A bullish engulfing pattern forms at the end of a downtrend, indicating a potential bullish reversal. On the other hand, a bearish engulfing pattern occurs at the end of an uptrend, suggesting a possible bearish reversal.

Importance of Engulfing Candlestick Patterns in Trading

Engulfing candlestick patterns hold significant importance in technical analysis and can greatly assist traders in making well-informed trading decisions. Here's why they are valuable tools for traders:

Significance in technical analysis

Engulfing candlestick patterns are considered reliable signals in technical analysis due to their clear visual representation. They provide traders with a distinct pattern to identify and analyze, making it easier to recognize potential trend reversals and capitalize on them.

Identifying trend reversals

Engulfing candlestick patterns serve as strong indications of trend reversals. When a bullish engulfing pattern occurs after a downtrend, it suggests a shift towards a bullish market sentiment. Similarly, a bearish engulfing pattern following an uptrend indicates a potential bearish market sentiment. Traders can use these patterns to anticipate and position themselves for profitable trades.

Entry and exit points

Engulfing candlestick patterns also help traders determine entry and exit points for their trades. By identifying these patterns, traders can enter the market at the beginning of a new trend, maximizing their potential profits. They can also use engulfing patterns as signals to exit their positions when the market sentiment starts to reverse .

How to Identify Engulfing Candlestick Patterns

To effectively utilize engulfing candlestick patterns, traders must learn how to identify them accurately. Here's a breakdown of the key steps to identify engulfing patterns:

Bullish engulfing pattern

A bullish engulfing pattern consists of two candles. The first candle is smaller and bearish, indicating a downtrend. The second candle is larger and bullish, completely engulfing the body of the previous candle. This pattern suggests a potential reversal from a bearish to a bullish market sentiment.

Bearish engulfing pattern

A bearish engulfing pattern follows a similar structure but in the opposite direction. The first candle is bullish, representing an uptrend, while the second candle is bearish and larger, fully engulfing the previous candle's body. This pattern suggests a potential reversal from a bullish to a bearish market sentiment.

Key characteristics to look for

When identifying engulfing candlestick patterns, there are key characteristics to consider:

- The size of the engulfing candle: The engulfing candle should be significantly larger than the preceding candle to indicate a strong shift in market sentiment.

- Confirmation: It's essential to look for confirmation from other technical indicators or analysis techniques to strengthen the validity of the pattern.

- Volume: Higher trading volume during the formation of an engulfing pattern further enhances its significance.

Tips for New Traders to Utilize Engulfing Candlestick Patterns

Now that we understand the significance of engulfing candlestick patterns let's explore some valuable tips for new traders to utilize them effectively:

Learn to identify reliable patterns

Engulfing candlestick patterns come in various shapes and sizes. It's crucial for new traders to learn to identify reliable patterns with a higher probability of success. This can be achieved through extensive study, practice, and analyzing historical charts.

Combine with other technical indicators

To increase the accuracy of engulfing patterns, new traders can combine them with other technical indicators, such as moving averages, oscillators, or support and resistance levels. By using multiple indicators, traders can confirm their analysis and make more informed trading decisions.

Practice proper risk management

Risk management is crucial in trading. When utilizing engulfing candlestick patterns, new traders should ensure they have a well-defined risk management strategy in place. This includes setting stop-loss levels, determining position sizes, and maintaining a disciplined approach to trading.

Backtesting and paper trading

Before implementing engulfing patterns in live trading, new traders should backtest their strategies. By reviewing historical charts and applying the identified patterns, traders can assess the patterns' effectiveness and fine-tune their approach. Paper trading, or simulated trading, can also be beneficial to practice using engulfing patterns in real-time market conditions without risking actual capital.

Continual learning and improvement

The world of trading is ever-evolving, and new traders should continuously learn and improve their skills. Engulfing candlestick patterns are just one aspect of technical analysis, and exploring other patterns, strategies, and market dynamics can further enhance trading proficiency.

Real-Life Examples and Case Studies

To gain a better understanding of how engulfing candlestick patterns work in real-life trading scenarios, let's explore a couple of examples:

Analyzing stock market scenarios

Suppose you are a stock trader analyzing a particular company's stock chart. After a prolonged downtrend, you identify a bullish engulfing pattern forming at a significant support level. This pattern suggests a potential reversal in the stock's price, indicating a favorable opportunity to buy and capitalize on the upward movement.

Evaluating cryptocurrency trends

Cryptocurrency markets are known for their volatility. By applying engulfing candlestick patterns, traders can identify potential trend reversals and profit from price movements. For instance, if a bearish engulfing pattern forms after a prolonged uptrend in a specific cryptocurrency, it may indicate a potential price correction or reversal. Traders can then consider taking short positions or exiting long positions to protect their profits.

Common Mistakes to Avoid When Using Engulfing Candlestick Patterns

While engulfing candlestick patterns can be powerful tools for traders, it's essential to be aware of common mistakes to avoid:

Overtrading based on one pattern

Relying solely on engulfing patterns without considering other factors or indicators can lead to overtrading. It's crucial to have a comprehensive trading strategy that combines multiple signals and confirms the patterns' validity before entering a trade.

Ignoring confirmation signals

Engulfing patterns should be used in conjunction with other technical indicators or analysis techniques for confirmation. Ignoring these confirmation signals may result in entering trades with lower probability, leading to suboptimal trading outcomes.

Neglecting market context

Engulfing patterns should always be analyzed within the broader market context. Understanding the overall market trend, support and resistance levels, and fundamental factors can provide valuable insights and prevent misinterpretation of patterns.

Failing to adapt to changing market conditions

Market conditions can change rapidly, and engulfing patterns that were previously reliable may lose their effectiveness. Traders must adapt to changing market conditions and continuously reassess the validity and success rate of engulfing patterns.

Conclusion

Engulfing candlestick patterns offer new traders a powerful tool to identify potential trend reversals and make informed trading decisions. By understanding the different types of engulfing patterns, learning how to identify them accurately, and incorporating them into a comprehensive trading strategy, new traders can enhance their profitability and navigate the financial markets more effectively.

FAQs

Q1. Can engulfing patterns be used for all financial instruments?

A1. Engulfing patterns can be applied to various financial instruments, including stocks, commodities, forex, and cryptocurrencies. However, it's important to consider the characteristics and volatility of each instrument when analyzing engulfing patterns.

Q2. Howreliable are engulfing patterns in predicting price movements?

A2. Engulfing patterns are considered reliable signals; however, they should be used in conjunction with other technical indicators and analysis techniques for confirmation. The reliability of engulfing patterns can vary depending on the market context and other factors influencing price movements.

Q3. Are engulfing patterns suitable for short-term or long-term trading?

A3. Engulfing patterns can be used for both short-term and long-term trading strategies. In short-term trading, traders can capitalize on immediate price reversals, while in long-term trading, engulfing patterns can help identify potential trendchanges over extended periods.

Q4. What are some alternative candlestick patterns to consider?

A4. Apart from engulfing patterns, there are several other popular candlestick patterns, such as doji, hammer, shooting star, and evening star. Each pattern has its own significanceand provides unique insights into market dynamics.

Q5. Should I solely rely on engulfing patterns for my trading strategy?

A5. Engulfing patterns should be used as part of a comprehensive trading strategy. It's important to consider other technical indicators, fundamental analysis, and market context to increase the probability of successful trades. Diversifying your trading approach can help mitigate risks and improve overall trading performance.