Strategies for Smart Entry Points: Dollar Cost Averaging and Moving Averages

Hey there, fellow investors and crypto enthusiasts! If you've ever wondered about the best strategies to find excellent entry points for your long-term investments in the volatile world of cryptocurrency, you're in the right place. In this article, we're going to dive into two powerful techniques that can help you make informed decisions: Dollar Cost Averaging (DCA) and utilizing Moving Averages.

- Click Here To Find Out More about How to use MACD Indicator?

- Click Here To Find Out More about How to Boosting Your Trading Confidence?

- Click Here To Find Out More about What is Bollinger Bands How to Use?

- Click Here To Find Out More about Why Crypto Investors Shift to Altcoins?

Understanding Dollar Cost Averaging (DCA)

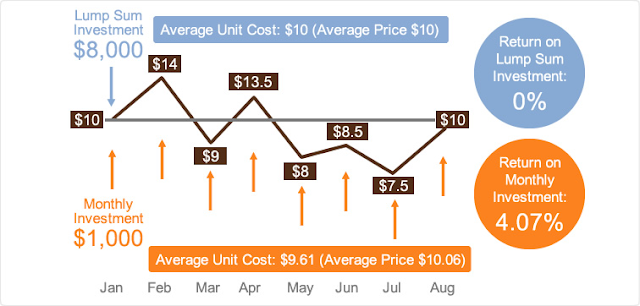

Dollar Cost Averaging (DCA) is a simple yet effective strategy that allows you to invest a fixed amount of money at regular intervals, regardless of market fluctuations. This approach helps you avoid the stress of trying to time the market perfectly and reduces the impact of volatility on your investments.

How Does DCA Work?

Imagine you're investing $100 every week in a cryptocurrency. If the price is high, you'll buy fewer units, and if the price is low, you'll buy more units. Over time, this strategy averages out the cost of your investment, potentially resulting in a lower average price per unit.

The Art of Timing: When to DCA

Timing your DCA intervals is crucial. It's a good idea to establish a consistent schedule, whether it's weekly, bi-weekly, or monthly. This way, you'll benefit from both high and low market periods, and emotions won't sway your decisions.

Deciphering the Signals

Understanding the signals from Market Cipher B requires some learning, but it can be a valuable addition to your investment toolkit. It's like learning to read the signs along a path, guiding you through the twists and turns of the crypto market.

DCA in the Long Run: Historical Success

DCA's success becomes even more evident when looking at historical data. Numerous studies have shown that consistent DCA over the long term often outperforms attempting to time the market, proving the effectiveness of a steady investment approach.

The Power of Moving Averages

Moving Averages are another tool that crypto investors can leverage. A Moving Average smooths out price data over a specific period, revealing trends more clearly. It helps filter out noise and highlights the general direction of the market.

Weekly vs. Daily: DCA Strategies

Choosing between weekly and daily DCA strategies depends on your risk tolerance and time commitment. Weekly DCA might be more suitable for those with busier schedules, while daily DCA could provide a more immediate response to market shifts.

- Click Here To Find Out More about Why Shiba Inu's BAD Token Surges 500%

- Click Here To Find Out More about How To Trade with Top 3 Reversal Patterns For Big Profits?

- Click Here To Find Out More about How to use 3 Strategies For Setting Stop Losses?

Backed by Historical Data: Moving Averages

Historical data analysis often includes Moving Averages to assess past performance and predict potential future trends. By identifying crossovers and patterns, investors can make more informed decisions about entry and exit points.

Conclusion

In the fast-paced world of cryptocurrency investment, finding smart entry points is essential for long-term success. Dollar Cost Averaging takes the pressure off timing the market perfectly, while Moving Averages provide valuable insights. By combining these strategies and staying informed about market indicators like Market Cipher B, you can navigate the crypto waters with confidence.

Frequently Asked Questions

Q1. What is Dollar Cost Averaging (DCA)?

A1 DCA is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of market fluctuations. This approach helps reduce the impact of volatility on your investments.

Q2. How does DCA work in the cryptocurrency market?

A2. DCA in the cryptocurrency market involves consistently investing a specific amount of money at set intervals, regardless of the coin's current price. Over time, this strategy can lead to a lower average price per unit.

Q3. Can DCA guarantee profits?

A3. DCA doesn't guarantee profits, but it helps mitigate risks associated with market timing. It's a long-term strategy that aims to average out your investment costs over time.

Q4. What are Moving Averages?

A4. Moving Averages are indicators that smooth out price data over a specified period, helping to identify trends and filter out short-term fluctuations.

Q5. Is timing the market crucial for success in crypto investment?

A5. Timing the market precisely is challenging and risky. DCA and tools like Moving Averages offer a more structured and informed approach to crypto investment, reducing the emphasis on perfect timing.

- Click Here To Find Out More about How to use Beginners Easiest Trading Strategy?

- Click Here To Find Out More about How to Gain 10x Profits?

- Click Here To Find Out More about Cardano Founder's Perspective on Ethereum's

- Click Here To Find Out More about Exploring DOGE and SHIB

Now you're armed with knowledge that can potentially transform your Bitcoin investments. Remember, whether you're reading Market Cipher B, tracking the 200-day moving average, or a combination of both, strategic buying and patience are your allies. Happy investing, and may your Bitcoin journey be a prosperous one!